The Body Shop has been successfully rescued from administration, thanks to a consortium led by British cosmetics magnate Mike Jatania. The acquisition deal, finalised on Friday, will preserve the remaining 113 UK stores and secure The Body Shop’s international presence, including outlets in Australia and North America.

Jatania’s growth capital firm, Auréa, co-founded with Paul Raphael, formerly of UBS, Credit Suisse, and Merrill Lynch, has acquired all of The Body Shop International’s assets. While the financial terms of the deal remain undisclosed, the new owners have committed to keeping all current UK stores operational. This move is expected to safeguard more than 1,300 jobs across the country.

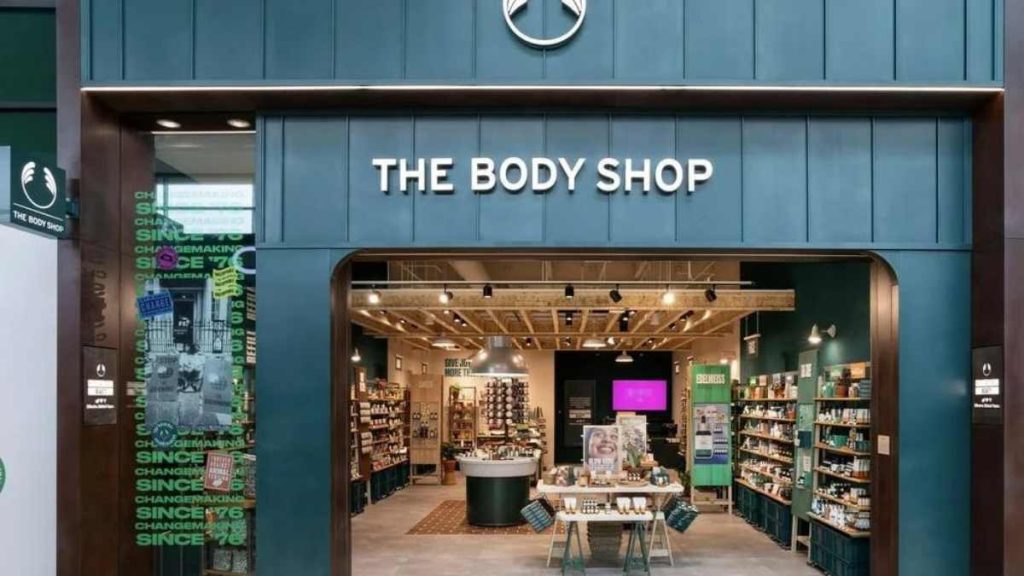

A spokesperson for Auréa highlighted the importance of maintaining the stores as a key part of The Body Shop’s customer connection. “We view the stores as essential to the brand’s relationship with its customers. We will continuously assess the store network to optimise its performance and ensure we are meeting customer needs effectively.”

The Body Shop, established in 1976 by Anita Roddick, faced significant financial difficulties leading to its administration in February. The company had been acquired by Aurelius for £207 million only three months prior but struggled to regain profitability. At the time of administration, it owed over £276 million to creditors.

Under administration by FRP Advisory, 85 stores were closed, and around 500 shop positions along with 270 office roles were lost. Despite these closures, the remaining 113 UK stores stayed open, while European and US outlets, along with some Asian franchise-operated stores, were shut down due to disrupted supply chains.

Auréa’s acquisition is the firm’s largest transaction to date, and the group is determined to restore The Body Shop’s global leadership in the ethical beauty sector. Jatania will take on the role of chair, while Charles Denton, the former CEO of Molton Brown, will serve as CEO.

The consortium is currently seeking additional working capital, with restructuring specialist Hilco reportedly set to provide £30 million. Auréa aims to leverage its investment expertise and industry knowledge to rejuvenate The Body Shop while upholding its core values and heritage.

Jatania, who previously managed Lornamead and sold it for approximately £155 million, expressed his enthusiasm about the acquisition: “We’ve secured an iconic brand with a strong consumer base across 70 markets. Our focus will be on exceeding customer expectations through product innovation and exceptional experiences, all while honouring The Body Shop’s ethical values.”

Denton shared his excitement about leading the revitalisation efforts, emphasising the need for bold strategies and a customer-centric approach. “Restoring The Body Shop’s unique, values-driven ethos is our priority. We are committed to a sustainable future for the brand.”

FRP Advisory’s Steve Baluchi welcomed the new ownership, recognising their successful track record in retail turnarounds. “We are pleased to transfer The Body Shop to experienced new owners with a clear vision for its future.”